Table of Content

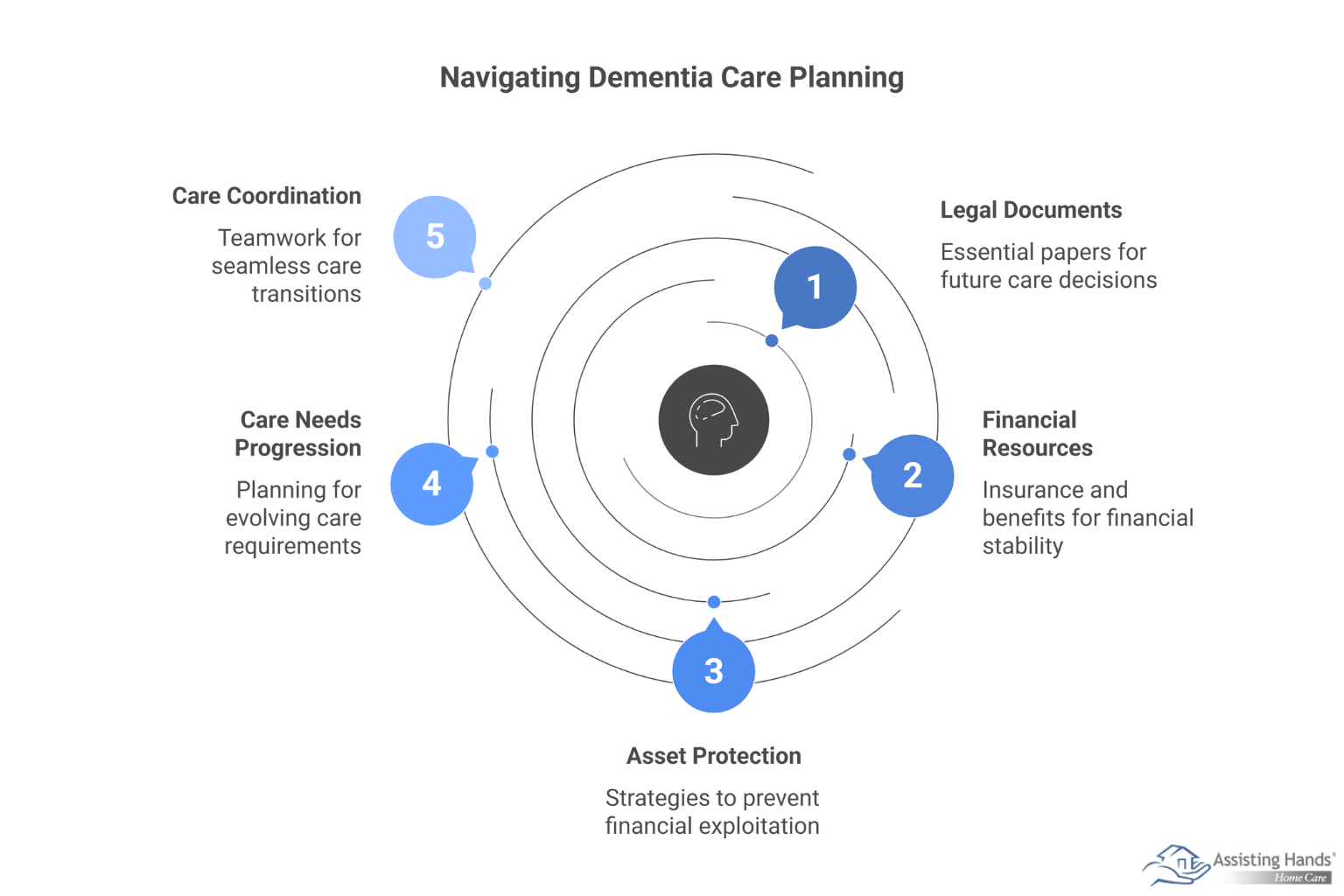

Dementia affects millions of families worldwide, bringing unique challenges that extend far beyond medical care. Early legal and financial planning can protect your senior loved one’s wishes, preserve family assets, and reduce stress during an already difficult time.

Establish Essential Legal Documents Early

The most critical step in dementia planning involves creating or updating key legal documents while your loved one still has the cognitive capacity to make informed decisions. These documents provide the legal framework for future care decisions and financial management.

Priority legal documents include:

- Durable power of attorney for healthcare – Allows a designated person to make medical decisions when your loved one cannot

- Durable power of attorney for finances – Grants authority to manage financial affairs, pay bills, and make investment decisions

- Advanced healthcare directive (living will) – Documents specific preferences for end-of-life care and medical treatments

- Last will and testament – Ensures assets are distributed according to your loved one’s wishes

- HIPAA authorization forms – Permits family members to access medical information and communicate with healthcare providers

Consider working with an elder law attorney who specializes in dementia-related legal issues. The attorney can ensure documents comply with state regulations and address specific concerns unique to progressive cognitive decline.

If your loved one’s wishes include living at home as long as possible, it’s a good idea to plan ahead for the possibility he or she may need help with the activities of daily living. One of the most challenging tasks of helping an elderly relative age in place safely and comfortably is researching agencies that provide elderly home care. Turn to Assisting Hands Home Care for reliable, high-quality in-home care for aging adults. We offer 24-hour care for seniors who require extensive assistance, and we also offer respite care for family caregivers who need a break from their caregiving duties.

Understanding available insurance options and government benefits can significantly impact your family’s financial stability throughout the dementia journey. Long-term care costs can quickly deplete savings, making early benefit planning essential.

Explore these financial resources:

- Long-term care insurance – Review existing policies or consider purchasing coverage while your loved one is still healthy.

- Medicare and Medicaid – Understand coverage limitations and eligibility requirements for dementia-related services.

- Veterans benefits – Research Aid and Attendance benefits for qualifying veterans and their spouses.

- Social Security Disability Insurance – Dementia may qualify for expedited disability benefits under the Compassionate Allowances program.

- Health Savings Accounts (HSAs) – These funds can cover qualified long-term care expenses tax-free.

Document all benefit applications and maintain organized records of approvals, denials, and appeals. The application process for government benefits can be lengthy, so starting early prevents gaps in coverage when care needs increase.

Financial planning is just one of the many things your loved one may need help with. Aging adults who require assistance with the tasks of daily living can benefit from reliable home care. Cincinnati, OH, families trust Assisting Hands Home Care to provide the high-quality care their elderly loved ones need and deserve. Our caregivers are trained to help seniors prevent and manage serious illnesses and encourage them to make healthier decisions as they age.

Protect Financial Assets and Prevent Exploitation

People with dementia become increasingly vulnerable to financial exploitation and poor decision-making as the disease progresses. Implementing protective measures early safeguards assets while preserving your loved one’s dignity and independence.

Key protective strategies include:

- Simplified banking – Consolidate accounts and set up automatic bill payments for essential expenses.

- Credit monitoring – Establish alerts for unusual account activity and consider freezing credit reports.

- Trusted contact designation – Provide financial institutions with authorized contacts who can be notified of suspicious activity.

- Limited access – Gradually restrict access to large sums of money while maintaining funds for daily needs.

- Investment reviews – Work with financial advisors to adjust investment strategies for capital preservation rather than growth.

Regular monitoring of financial statements helps you identify potential exploitation early. Consider appointing a trusted family member or professional fiduciary to oversee financial matters as cognitive abilities decrease.

Plan for Progressive Care Needs and Associated Costs

Dementia care needs evolve throughout the disease’s progression, requiring different levels of support and associated expenses. Creating comprehensive care plans helps families prepare financially and emotionally for these transitions.

Consider the progression of care needs:

- Early stage – Occasional assistance with complex tasks, medication organization, and transportation

- Middle stage – Increased supervision, possible adult day programs, and home modifications for safety

- Late stage – Full-time care, specialized dementia care facilities, or intensive home care services

Research care options in your area and their associated costs. Home care expenses can range from part-time assistance to 24-hour care, while memory care facilities vary significantly in pricing and services offered. Understanding these costs allows families to make informed financial decisions and explore funding options before immediate needs arise.

Create a Comprehensive Care Coordination Plan

Effective legal and financial planning requires coordination among multiple professionals and family members. Establishing clear roles and communication systems ensures seamless care transitions and protects your loved one’s interests throughout the dementia journey.

Build your care team to include:

- Elder law attorney – Provides ongoing legal guidance and document updates as needs change

- Financial planner – Optimizes assets and plans for long-term care expenses

- Healthcare providers – Coordinate medical care and provide documentation for benefit applications

- Care managers – Professional geriatric care managers can coordinate services and monitor care quality.

- Family members – Assign specific roles to prevent conflicts and ensure all aspects of care are addressed.

Regular team meetings can address emerging challenges and adjust plans as the disease progresses. Maintaining detailed records of all planning decisions creates a road map for future care providers and family members who may need to step into caregiving roles.

Highly trained caregivers with experience in caring for seniors with dementia can be a fantastic resource for family members. For trusted and reliable dementia care, Cincinnati families can turn to Assisting Hands Home Care. We are experts in caring for seniors with memory-related conditions, our caregivers are available 24/7, and all of our dementia care programs are backed with a 100% satisfaction guarantee. To create a customized in-home care plan for your loved one, call us today.